Ny State Standard Deduction 2025. December 21, 202317 min read by: Instead, taxpayers can claim a standard deduction based on their filing status:

Employers in new york state must provide all employees time off for meals, after working a certain number of hours. Ny state tax rates are 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.5%, 10.3% and 10.9%.

The new york tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in new york, the calculator allows you to calculate.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, Here's who pays new york state tax, residency rules and what's taxable. New york income tax calculator | tax year 2025.

Federal Standard Deduction 2025 Audrye Jacqueline, For heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100. The standard deduction for a single filer in new york for 2025 is $ 8,000.00.

Printable Itemized Deductions Worksheet, Don't forget, the deadline for filing. For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing.

Best Answer What Is The Standard Deduction For New York State? [The, In general, employers must provide at least 30. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $ 1,550.00 new york residents state income tax tables for married (separate) filers in.

Standard Deduction 2025? College Aftermath, Single individuals and married persons filing separate returns: For taxpayers who are married and filing jointly, the standard deduction for the 2025.

State Of Maine 2025 W4 Form Printable Forms Free Online, Updated for 2025 tax year on feb 16, 2025. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $ 1,550.00 new york residents state income tax tables for married (separate) filers in.

State Standard Deduction Amounts, That’s a $750 increase over 2025. The median income for all households is $89,689.

Standard Deductions for 20232024 Taxes Single, Married, Over 65, How much is the standard deduction for 2025? In general, employers must provide at least 30.

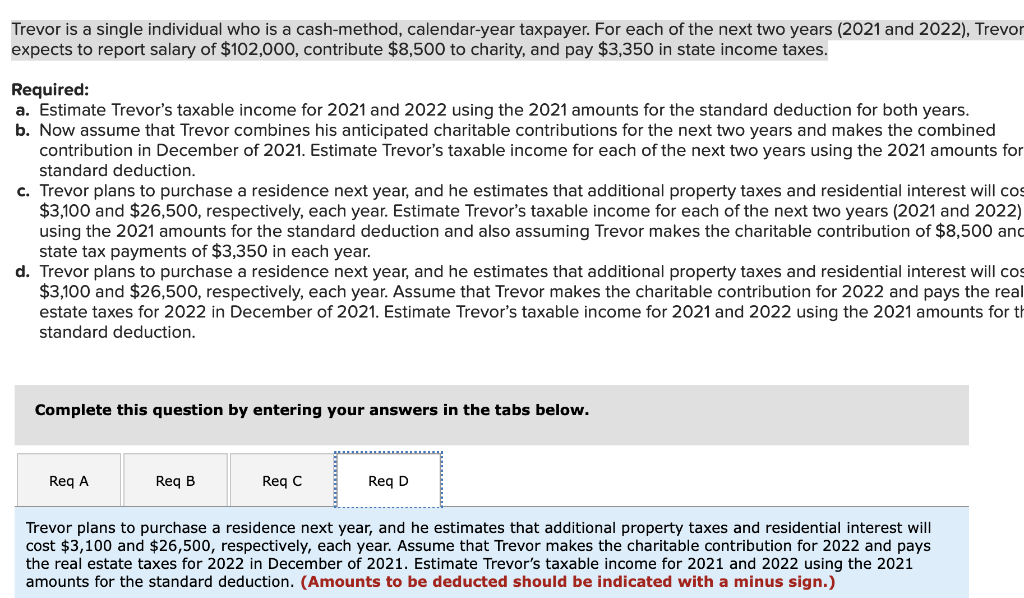

Solved Trevor is a single individual who is a cashmethod,, Married individuals and surviving spouses filing joint returns: Updated for 2025 tax year on feb 16, 2025.

IRS Announces Inflation Adjustments to 2025 Tax Brackets Foundation, New york income tax calculator | tax year 2025. Single (cannot be claimed as a dependent) married, filing separately.